A few readers have recently asked me about details relating to the credit cards offered by the major casino programs. In the coming weeks I’ll take a look at a few different cards linked to various players club offerings, and what value you can derive from them.

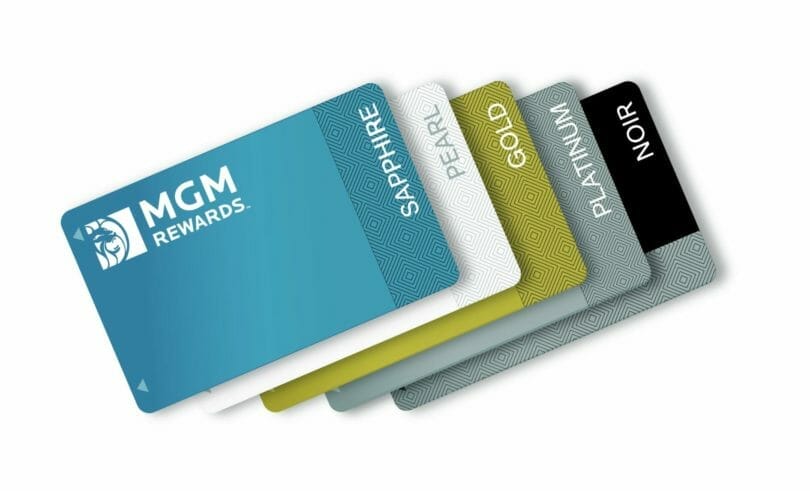

Let’s start by looking at the MGM Rewards Mastercard. The card offers some concrete perks, particularly for lower tier players, and can help you accrue points and tier credits. Below is a summary of the program as of winter of 2022, although from the looks of things it’s been pretty stable in recent years, minus a couple adjustments caused by the transition to the new MGM Rewards program.

What You Get

Every purchase with the MGM Rewards Mastercard earns you both points and tier credits. Remember, in MGM Rewards, there are three buckets of things you accrue:

- Tier Credits are your scorecard to determine your score for the year, and based on that, your tier level. They have no cash value but higher tiers can unlock better rewards.

- MGM Rewards Points (formerly Express Comps) are the main comp dollars and can be redeemed for food and experiences such as shows or dining. Shopping locations generally do not accept them.

- Slot Dollars (formerly Points) are a bonus bucket of sorts that can be redeemed either for more Express Comps, or free play on electronic machines like slots or video poker (barring specific machines, like linked progressives).

With the credit card you accrue tier credits and MGM Mastercard Points (a new fourth bucket since the rebranding of the rewards program). How fast you accrue depends on the type of purchase:

- 3x Tier Credits and MGM Mastercard Points per $1 spent at Mlife Rewards destinations nationwide

- 2x Tier Credits and MGM Mastercard Points per $1 spent on gas and at supermarkets

- 1x Tier Credits and MGM Mastercard Points per $1 spent everywhere else.

The new MGM Rewards Mastercard site explains how this new bucket of points can be applied:

Those rewards can be redeemed for Slot Dollars or MGM Rewards Points to use towards rooms, dining and entertainment.

So with this new setup, you can either opt for Slot Dollars or MGM Rewards Points, whichever you prefer, which is a nice element of flexibility. It’s early days in the new program, but I had seen reports some got Slot Dollars by default, but could have them flipped to MGM Rewards Points, but I suspect that’s just a temporary bridge until they can smooth this all out.

As such, you can earn between 1 and 3 cents per dollar in value, depending on where you are, and have your choice of how they’re applied. If you spend a lot of money at MGM resorts, this can be a nice bonus on top of your normal spend; otherwise it’s in a mediocre place on the credit card earnings world, restricted to just MGM properties vs. other travel cards where you have a much broader array of opportunities.

There is a signing bonus, like with many reward credit cards. In this case you get 10,000 bonus points (worth $100) when you complete $1,000 in spending on the card. This would of course be on top of the 1,000-3,000 points you’d earn from that spend out of the gate.

A couple of other key points: You get automatic Pearl status with the credit card, and because you’re earning points through regular use of the card, it keeps your account active, avoiding the 6 or 12 month expiration timelines that would normally exist depending on your tier. They also promise priority hotel check-in with the card.

The MGM Rewards Mastercard has no annual fee and no foreign transaction fees, making it a good travel card option.

Is It Worth It?

If you’re getting comped for a lot of things at MGM Rewards locations, it’s going to be somewhat difficult to actually have ways to earn that 3x rewards. So then you’re down to a more standard 1x and 2x category setup. The reality is a lot of other credit cards offer this or better, and so you’ll have to ask yourself if the rewards through Mlife specifically is more useful than a more standard cashback credit card, for instance.

If you spend a lot on cards and want to use anything at your disposal to achieve a higher tier, that’s certainly an option. Keep in mind you get 1-3 tier credits per $1 of spend on the card, whereas you can get in Las Vegas 10 tier credits per $3 gambled on many slots, which has an expected loss of around 30 cents.

So there are more efficient ways to earn tier credits if you’re in Vegas. If you’re in a regional market it’s 2 tier credits per $3 gambled, so a lot slower, and the card could help seal the deal for a higher tier.

I personally would not make an MGM card my primary card, as I already have achieved Gold status for years without the need for a special card. But for players who don’t get comped rooms, spend a good amount at MGM Rewards properties, or want to accelerate their tier opportunities, this could be a helpful piece of the puzzle.

To learn more or to apply for the card, visit the MGM Rewards Mastercard page on the MGM website.